How Much Is Federal Gift Tax 2025

BlogHow Much Is Federal Gift Tax 2025 - The 2025 gift tax limit is $18,000, up from $17,000 in 2023. Gift Tax Limit 2023 Calculation, Filing, and How to Avoid Gift Tax, The gift tax is intended to discourage large gifts that could. For married couples, each spouse could gift up to $17,000, resulting in a combined limit of $34,000.

The 2025 gift tax limit is $18,000, up from $17,000 in 2023.

Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2025 is $18,000 per giver per recipient.

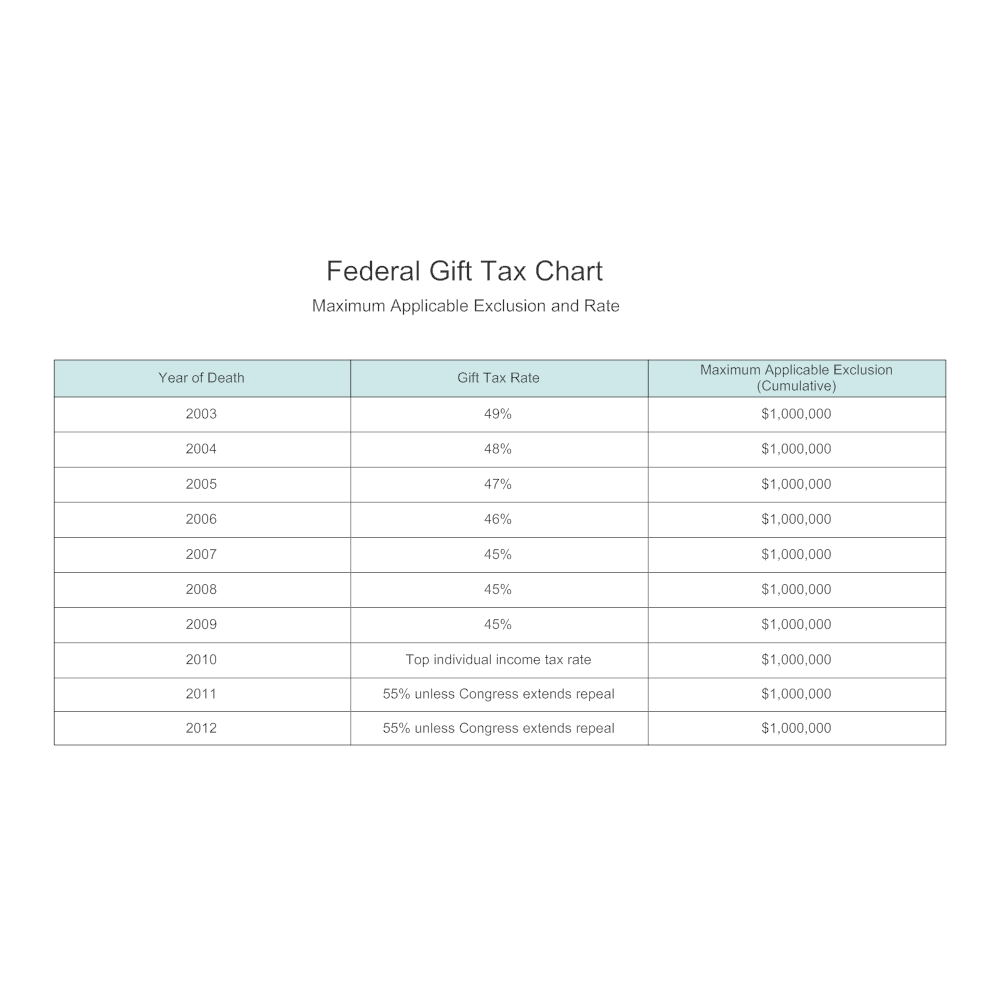

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, For married couples, the limit was $17,000 each, for a total of $34,000. Married couples can each gift $18,000 to the same person, totaling.

How Are Federal Gift and Estate Taxes Paid YouTube, The 2023 gift tax limit was $17,000. In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

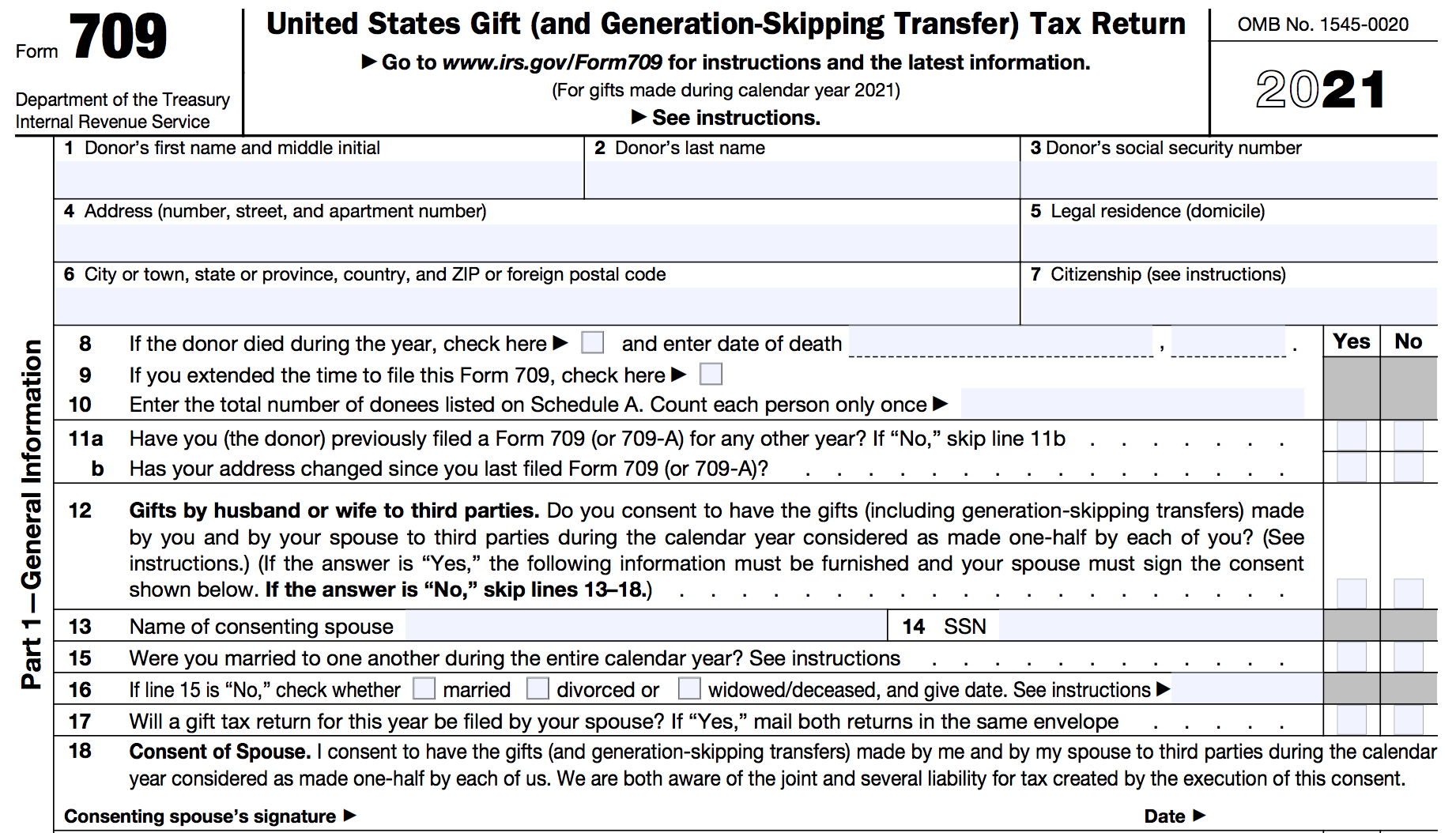

A uses $9 million of the available bea to reduce the gift tax to zero.

H20 Glow Nights 2025. (updated march 14, 2025.) previously known as h2o glow nights, this […]

Agt July 25 2025. Here is everything we know about agt 2025, including judges, host, […]

Gift Tax Rate Table 2025 Beckie Joelynn, Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2025 is $18,000 per giver per recipient. Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2025, $18,000) per.

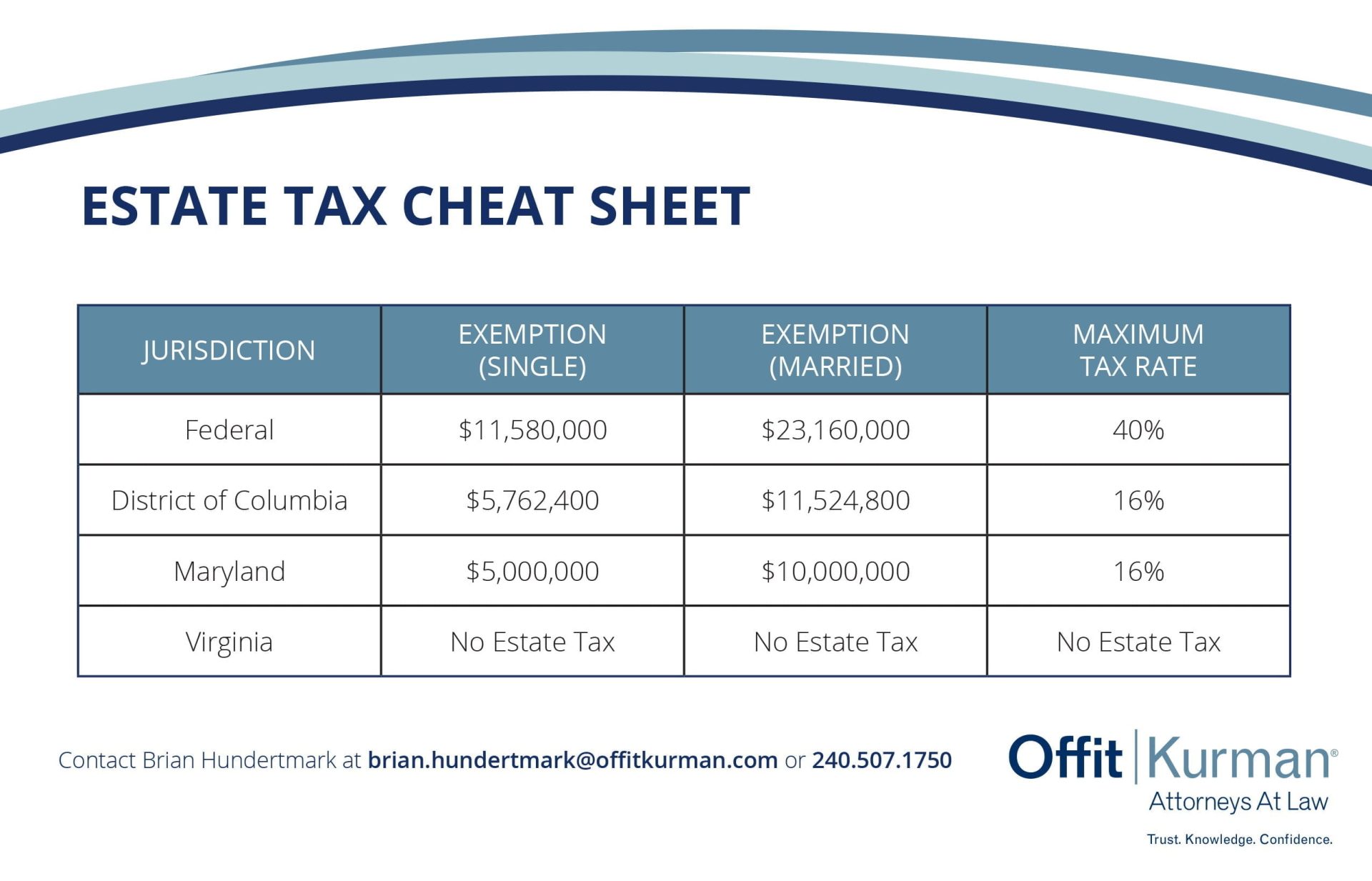

Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2025, $18,000) per. The united states government imposes a gift tax on gifts of money and other property that exceed the annual gift tax limit of $18,000 in 2025.

Married couples can each gift $18,000 to the same person, totaling.

How Much Is Federal Gift Tax 2025. The federal estate, gift, and gst tax exemptions for u.s. There is an annual limit on how.